Renters Insurance in and around Dallas

Dallas renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented property is home. Since that is where you kick your feet up and relax, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your sports equipment, guitar, hiking shoes, etc., choosing the right coverage can help protect you from the unexpected.

Dallas renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented apartment include a wide variety of things like your set of favorite books, couch, TV, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Rob Braun has the dedication and experience needed to help you choose the right policy and help you keep your things safe.

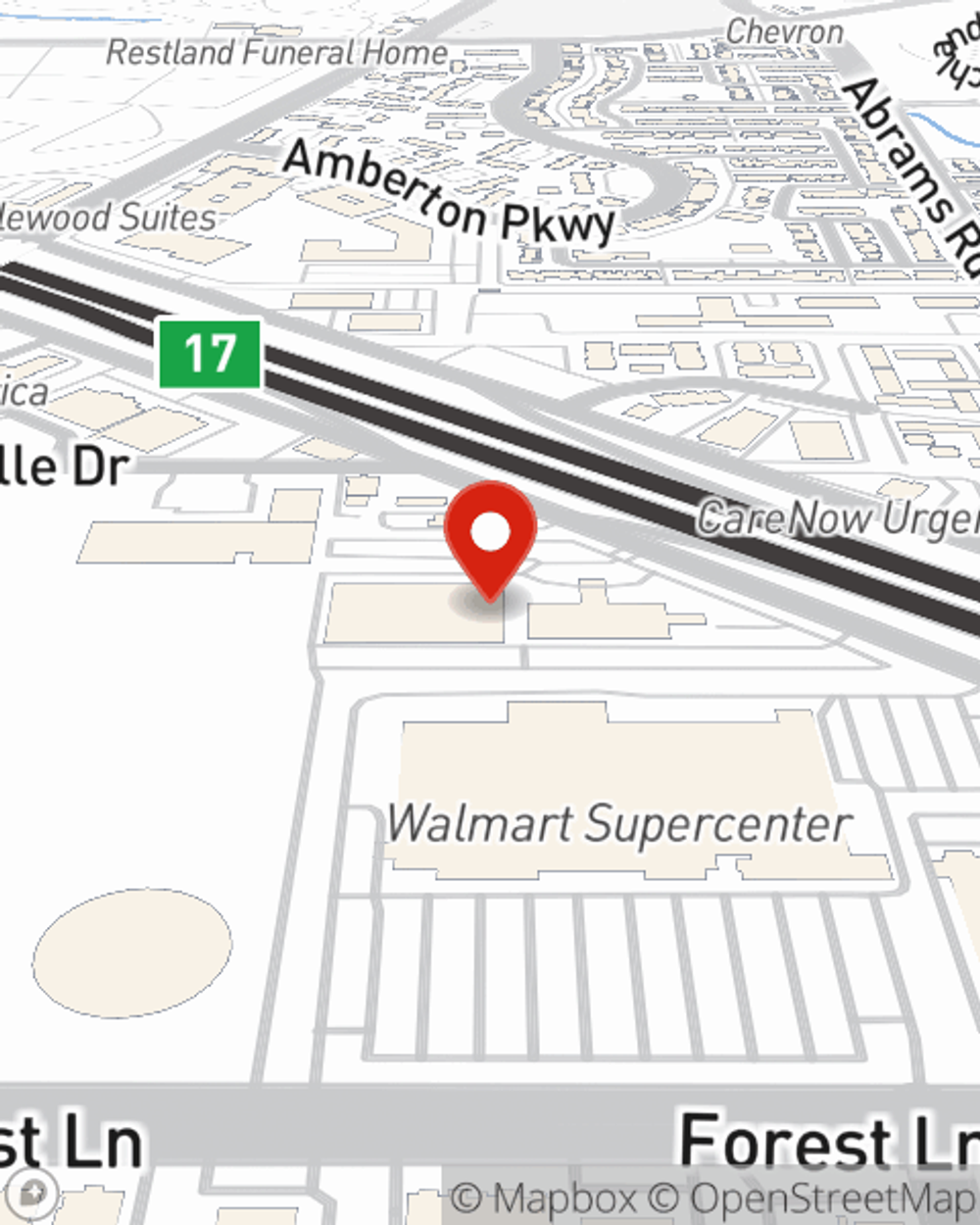

A good next step when renting a townhouse in Dallas, TX is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online now and learn more about how State Farm agent Rob Braun can help you.

Have More Questions About Renters Insurance?

Call Rob at (214) 343-1515 or visit our FAQ page.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.